About

- Multi-account exposure-based cost-minimizing rebalancing

- Calculate an optimal set of transactions in your investment portfolio to achieve the desired asset allocation, considering both individual assets and broader exposures (e.g., asset classes, styles, regions, strategies) while respecting additional allocation and transaction constraints.

- Complete privacy and security

- Everything is stored encrypted and only you can decrypt your data. No tracking. No personal data collection. Portfolio calculations are performed in an anonymized and scaled form, so it is impossible to determine actual assets and size of your portfolio. Instead of promising not to share your data, I just have nothing to share or to leak (even passwords).

- Straight and square pricing

- You know all the costs and limits beforehand. There will be no charges you did not explicitly authorize, no sudden price increases, no dark patterns, no marketing calls and emails.

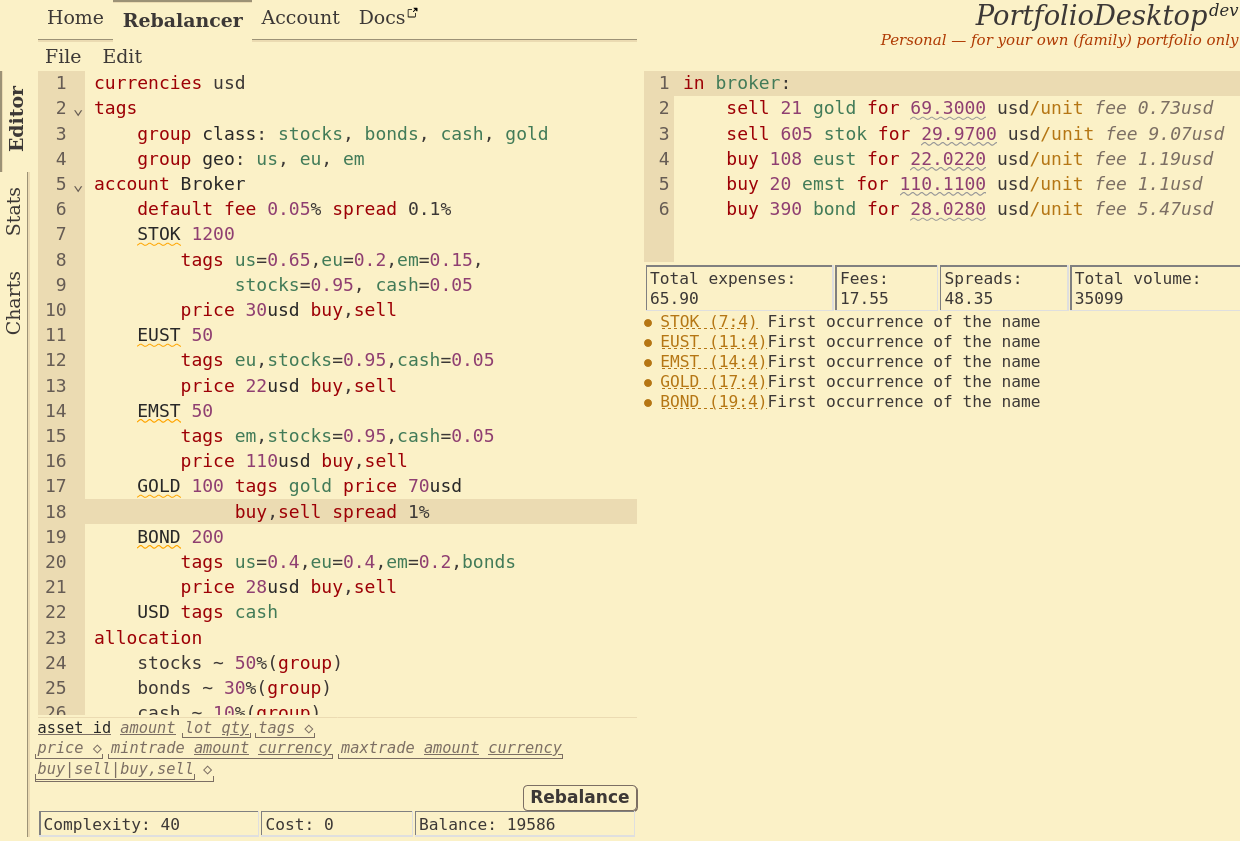

- Human-readable portfolio specification language

- Define and view your desired portfolio composition on one page, without numerous complex and laggy UI forms. See examples and the reference guide.

- API access

- If you run a portfolio tracking service, provide advanced rebalancing capabilities to your customers.

User Interface

Editor

of the spec syntax.

in portfolio currency.

to the relevant place in the spec.

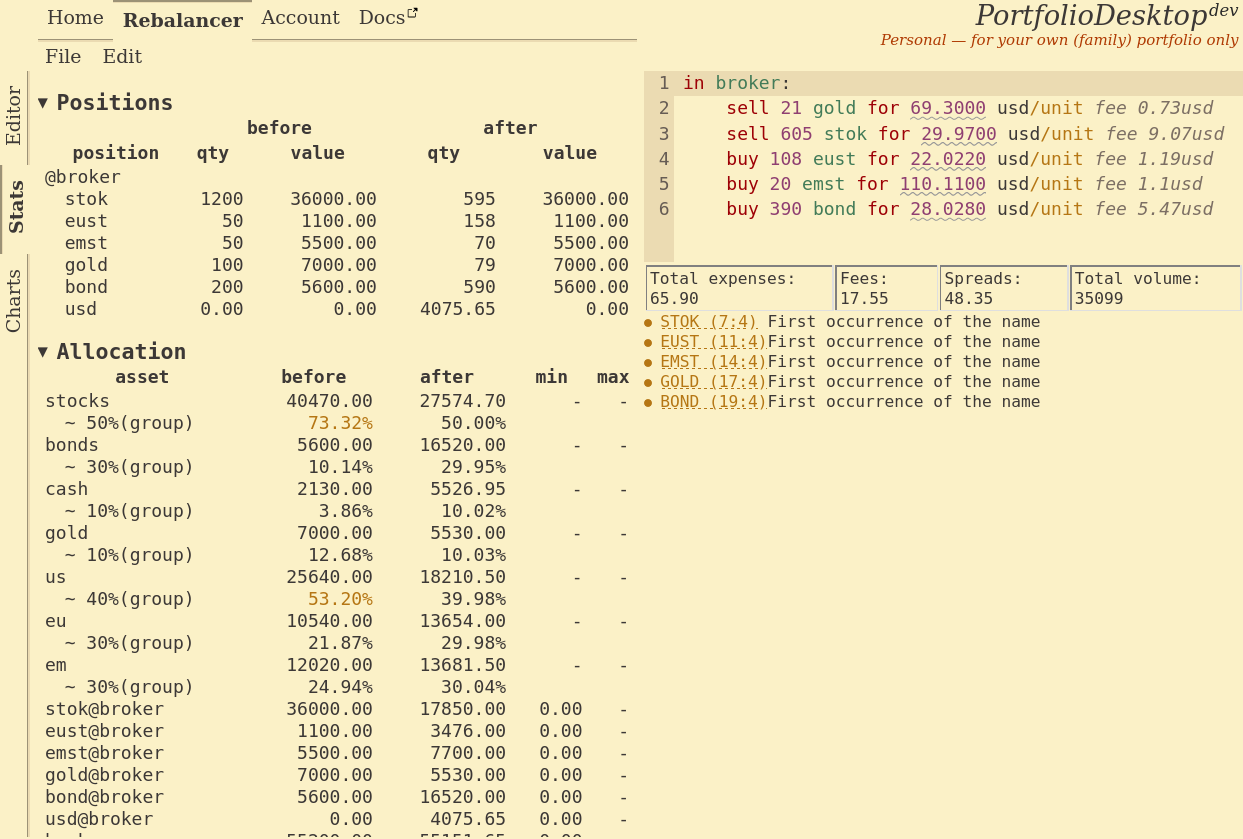

Statistics

Shows positions in your portfolio before and after rebalance

with their values in portfolio currency.

with their allocation rules.

as well as violations of constraints, are highlighted.

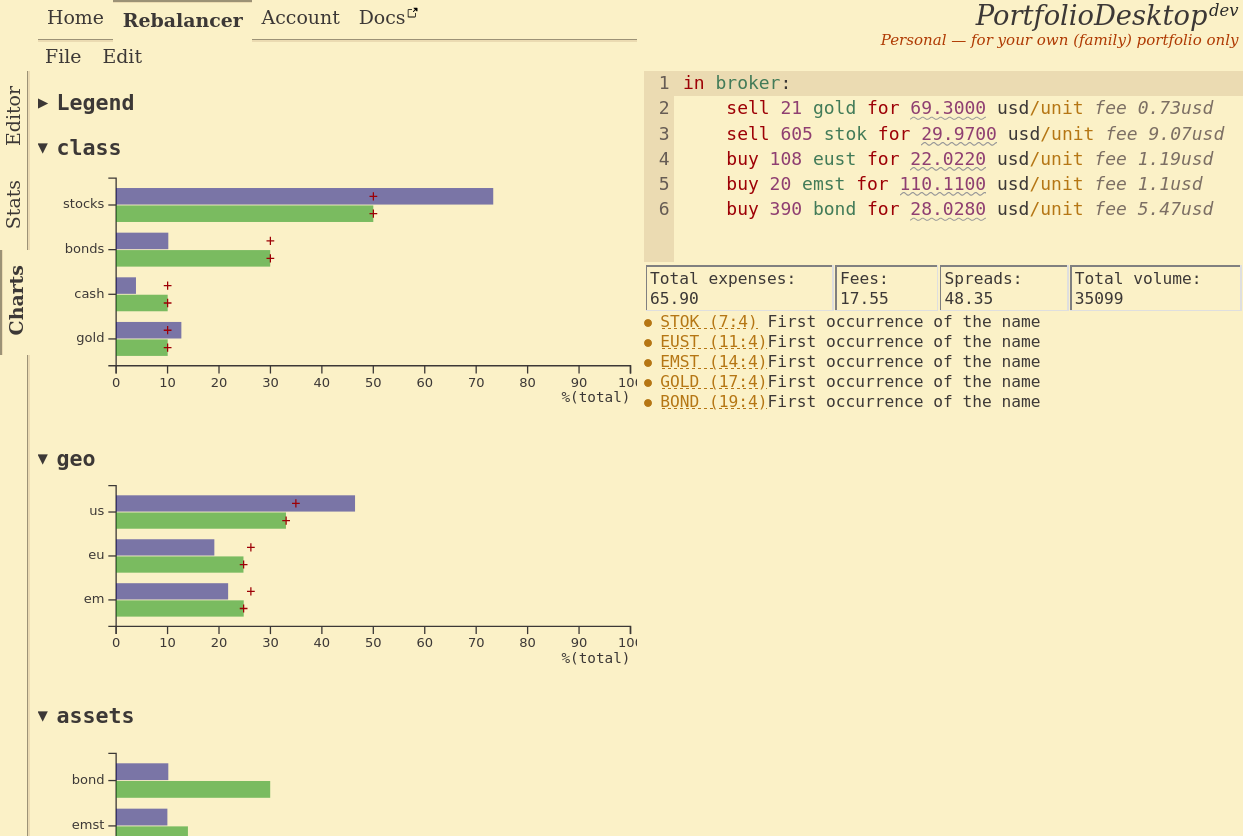

Charts

by tag group, account (if several), asset,

and position aggregate with defined rules,

before and after rebalace.

are shown in the diagrams.

gets immediately reflected in the Charts (and Statistics) pane.

Roadmap

- Tax modelling, calculation and optimization.

- Market data integration and portfolio analysis.

- Custom datasets and scratchpads for portfolio and other financial calculations.

- Taking into account long-term costs of allocation.

- Prospective asset allocation modelling and financial planning.

Pricing

The service uses a tiered pricing model: you pay separately for license, compute (as the service is quite computation-heavy) and additional features (e.g. market data, but nothing is available now).Compute prices

Computational resources required to process a rebalancing request are estimated in complexity points (CP).

The complexity of a request is calculated as follows:

- Each possible position — +1pt.

- Each possible transaction — +1pt.

- Minimum transaction amount — +1pt.

- Fixed and/or variable transaction fee — +1pt for all.

- Setting minimum/maximum transaction fee — +1pt for each element.

- Setting fixed minimum/maximum position/aggregate value (except min=0) — +1pt.

- Setting limit on a group of transfer transactions — +1pt.

- Any other constraint or target for assets — +2pt.

See an example of a portfolio specification with 60 CP complexity

currencies usd, eur=1.1

tags

money

group class: stocks, bonds, cash, gold

group geo: us, eu, em

assets

US_FUND

tags us, stocks=0.95, cash=0.05

price 30usd lot 10

EU_FUND

tags eu, stocks=0.95, cash=0.05

price 22usd lot 10

EM_FUND

tags em, stocks=0.95, cash=0.05

price 110usd, *eur lot 10

account Broker

default fee 0.05%

default spread 0.2%

US_FUND 700 buy,sell

EU_FUND 200 buy,sell spread 0.3%

mintrade 100usd maxtrade 5000eur

EM_FUND 500 buy,sell

GOLD_FUND 100 tags gold price 70usd buy,sell

GLOBAL_BONDS_FUND 100 price 28usd

tags us=0.4,eu=0.4,em=0.2,bonds

buy,sell

USD tags cash,money

EUR tags cash,money

transfers

out usd -> tax_deferred max 5000usd

account Tax_Deferred

default fee 0.5% spread 0.2%

US_FUND 300 buy,sell

EU_FUND 100 buy,sell fee 2%

USD

allocation

stocks ~ 50%(group)

bonds ~ 30%(group)

gold ~ 10%(group)

us ~ 50%(group)

eu ~ 25%(group)

em ~ 25%(group)

tax_deferred min current+2500usd

money ~ 0%(total)

License types

Compute

- Only the points exceeding the threshold are charged against your CPs balance.

- Do not expire.

Personal

- Single account.

- Single portfolio.

- 60 CP threshold

- High-priority processing (0.1 CP per request).

- Encrypted server-side storage for synchronization between devices.

PersonalPro

- Single account.

- Up to 3 portfolios.

- 100 CP threshold

- Personal features

- High-priority processing.

Business

- Single account.

- Up to 100 portfolios.

- 100 CP threshold

- PersonalPro features

- Certain additional features (when developed).

- E-Mail support.

Corporate

- Multiple accounts.

- Unlimited portfolios.

- 100 CP threshold

- Account management.

- Business features.

- API access.

- High-priority e-mail support.

- Bulk compute prices and custom development.